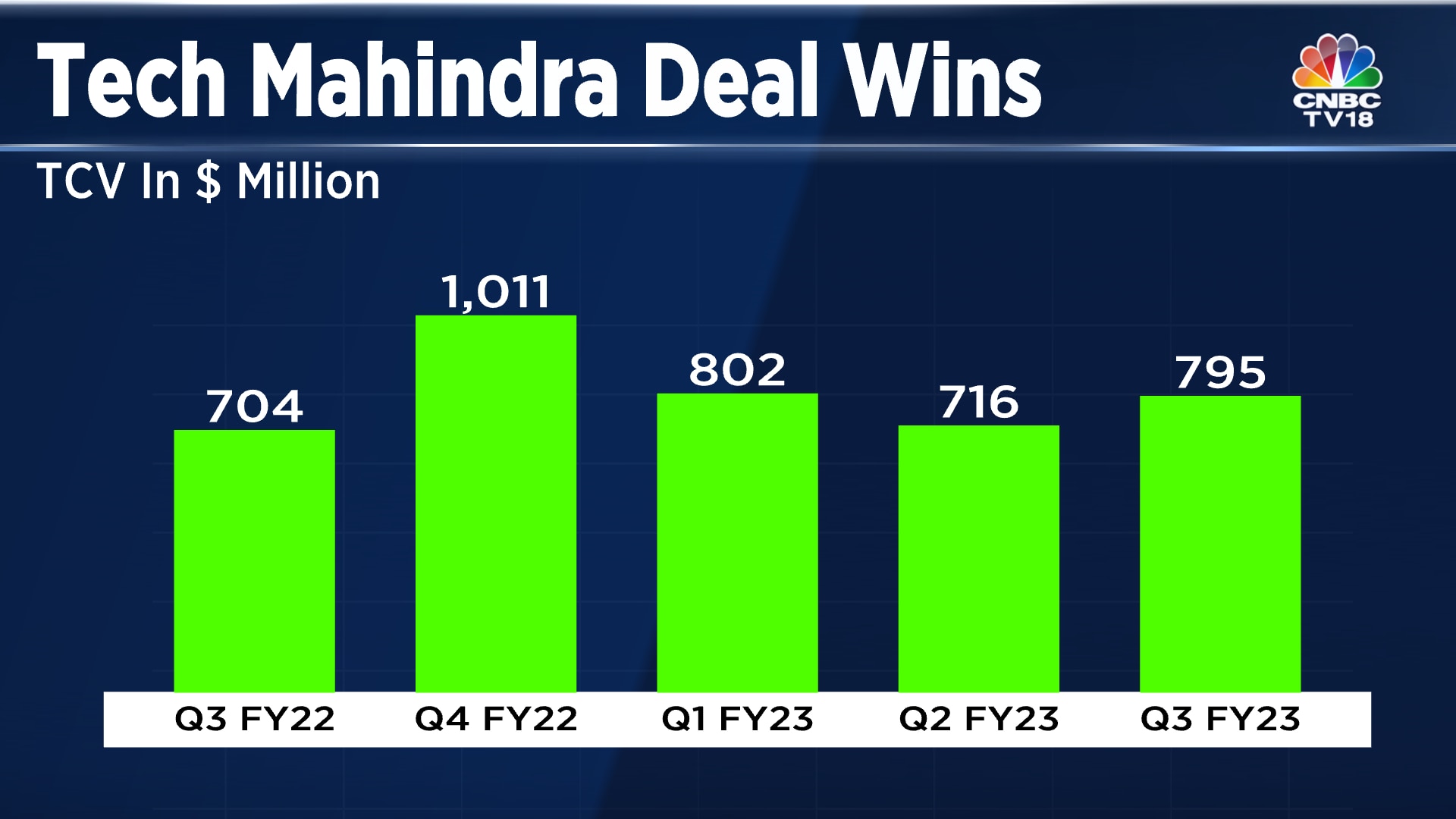

JM Financial said that deal wins were expected in the range of $500 million - $700 million due to delay in deal closures as compared to the guided band of $700 million - $1,000 million.

Tech Mahindra will be among the last two largecap IT companies to report March quarter results on Thursday. Headwinds among some top clients is likely to keep revenue growth muted.

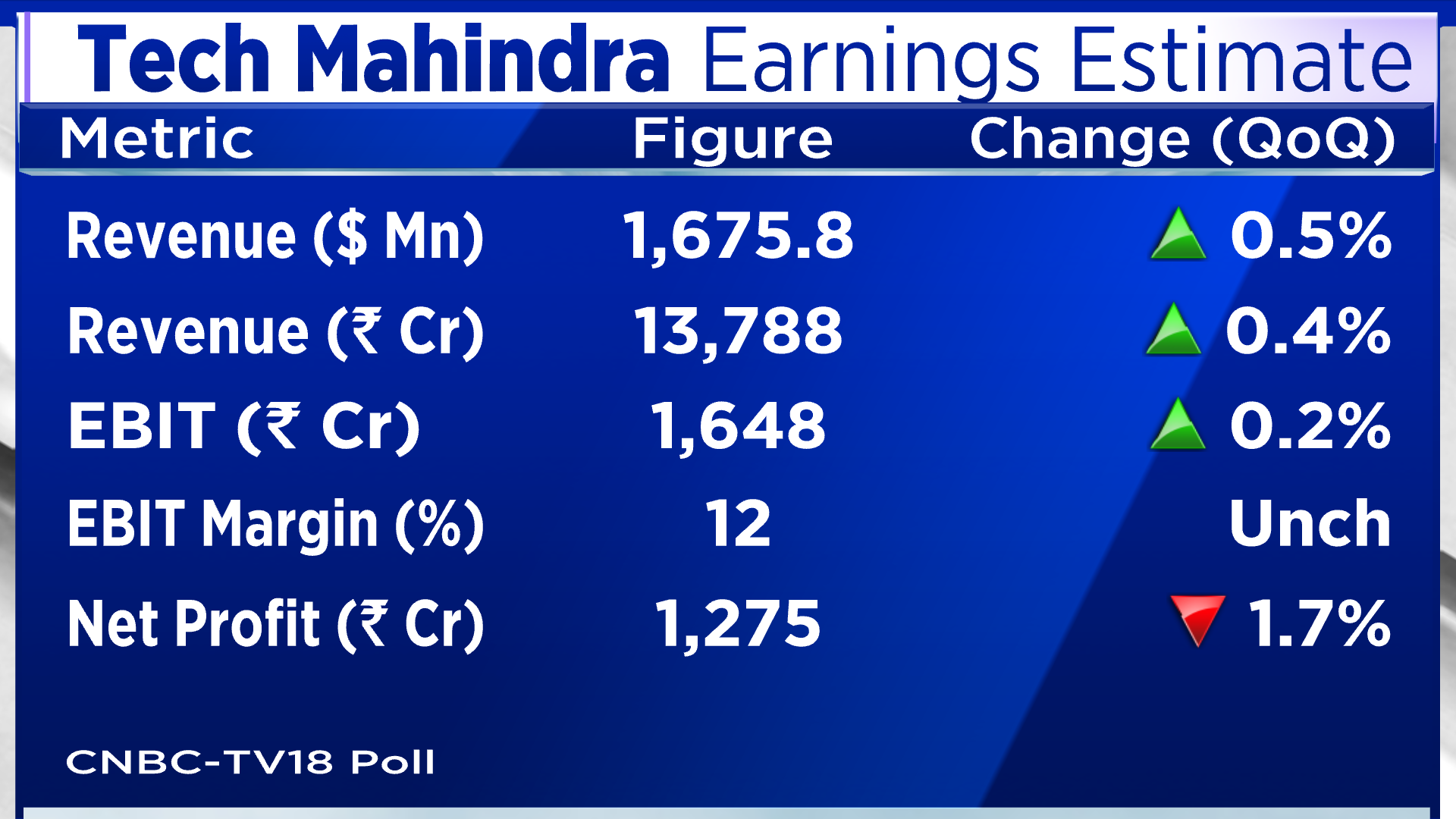

A CNBC-TV18 poll indicates that Tech Mahindra's revenue growth in both rupee and US Dollar terms would remain flat. Operating profit and margin is likely to remain little changed as well on a sequential basis.

Brokerage firm CLSA believes that deal wins for Tech Mahindra are likely to moderate below the $700 million mark, which has been the run-rate over the last five quarters.

JM Financial said that deal wins were expected in the range of $500 million - $700 million due to delay in deal closures as compared to the guided band of $700 million - $1,000 million.

Tech Mahindra's revenue is likely to decline by 0.4 percent in constant currency terms, due to the troubles earlier highlighted with some of the top clients. This had led to muted growth in the December quarter as well, where revenue grew only 0.2 percent in constant currency.

Margin for the quarter is likely to remain unchanged as the decline in revenue will offset benefits to margin due to rupee tailwind and supply side rationalisation.

Outlook for the top clients is where caution is warranted. Revenue from the top five clients declined 4.8 percent sequentially and 15.2 percent year-on-year in the December quarter. The management attributed the decline to headwinds in a couple of clients due to internal restructuring.

The management expects these issues to bottom out this quarter, thereby making the revenue growth and exit margin guidance for financial year 2024 extremely critical.

Current MD & CEO CP Gurnani will be retiring from the company on December 19, 2023. Mohit Joshi, former President at Infosys will take over the reins.

The CEO choice marks a shift away from Tech Mahindra’s focus on telecom as the key business driver, and more towards the non-telecom business. Nearly 40 percent of Tech Mahindra's revenue comes from the CME vertical.

The exposure to the communications vertical led to two consecutive downgrades for Tech Mahindra earlier this month from JPMorgan, and Citi.

Shares of Tech Mahindra have been flat so far on a year-to-date basis. The stock is 5 percent away from a 52-week low of Rs 944.

(Edited by : Hormaz Fatakia)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!