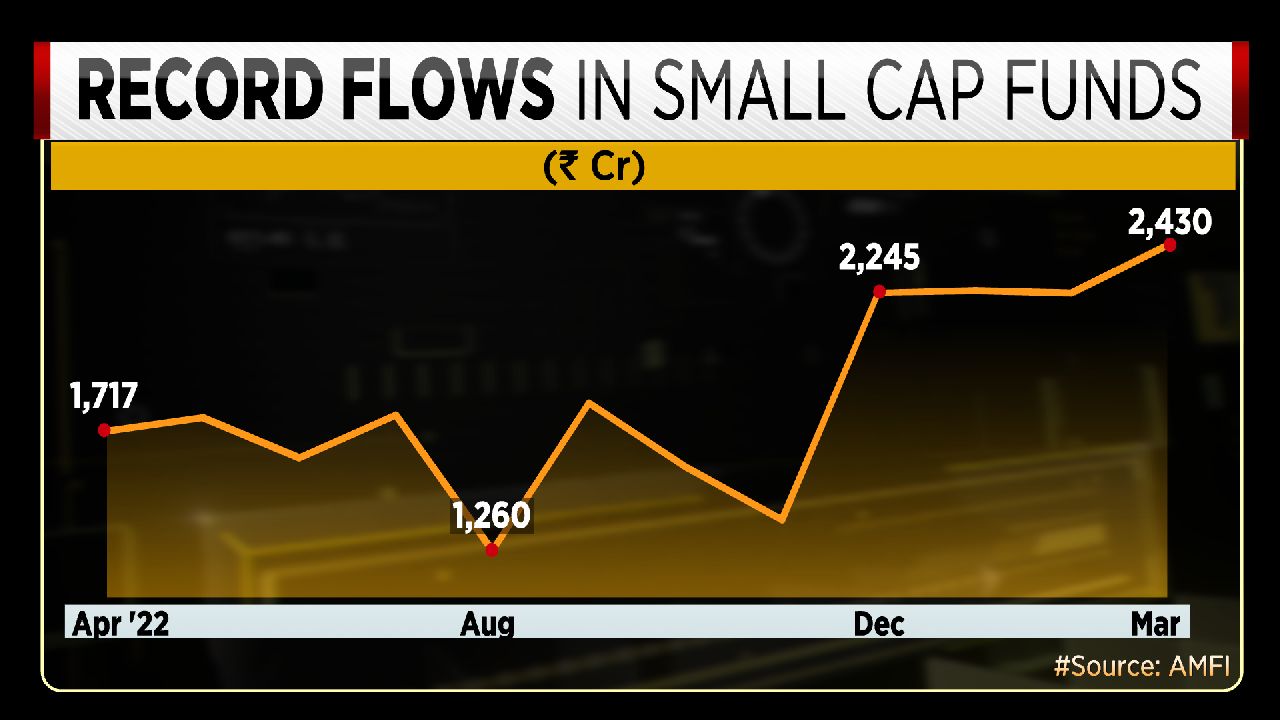

The 2022-23 fiscal witnessed a favourable period for small-cap funds, as the total inflows into this category amounted to Rs 22,103 crore for the entire year. Notably, the month of March recorded the highest inflows ever in this category. Throughout the year, there were no outflows, with inflows ranging between Rs 1,300 crore to Rs 2,400 crore per month.

In April, inflows stood at Rs 1,717 crore and remained stable at these levels, barring a significant decline in August. However, from December onwards, inflows surged and exceeded Rs 2,200 crore, which continued for the last four months of FY23, culminating in record-high inflows in March.

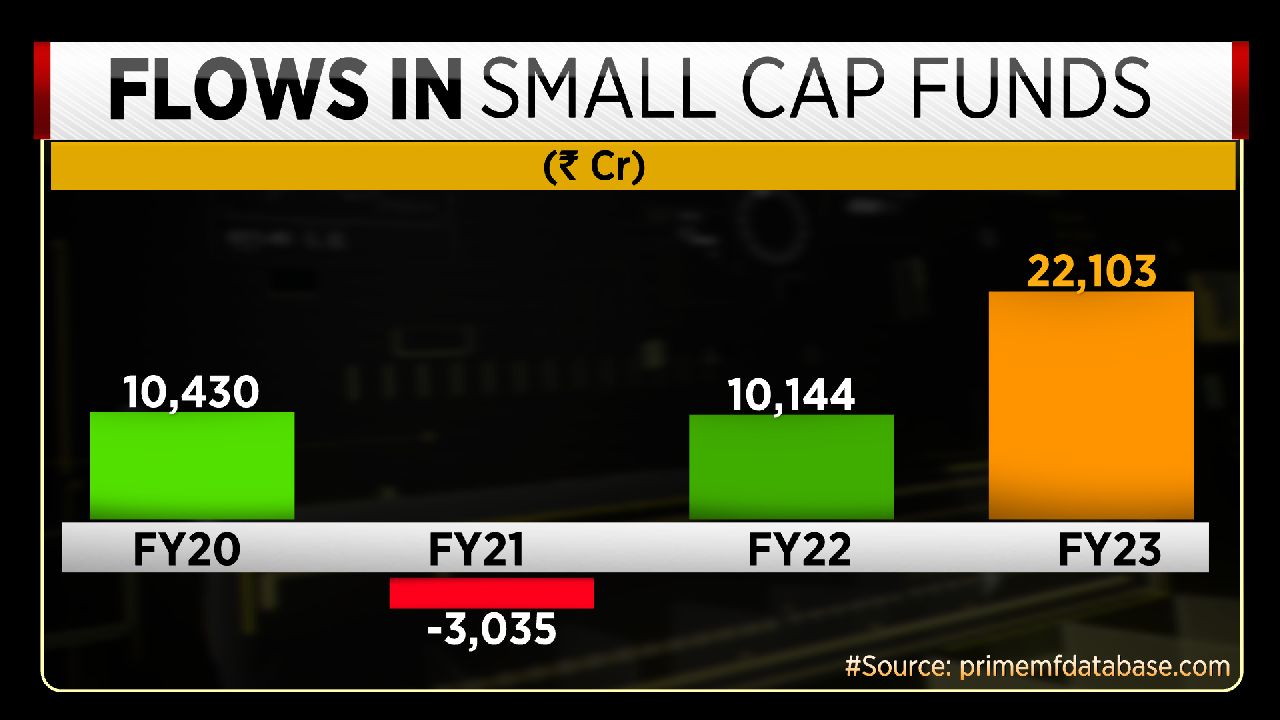

There has been a significant surge in inflows in FY23 compared to the last few years. In FY22, there were inflows of Rs 10,144 crore, while FY21 saw outflows of Rs 3,035 crore, and FY20 recorded inflows of Rs 10,430 crore.

Thus, the jump in FY23 inflows is considerable. Additionally, small-cap funds experienced outflows in some months during FY22 and FY21, whereas all months had positive flows in FY20.

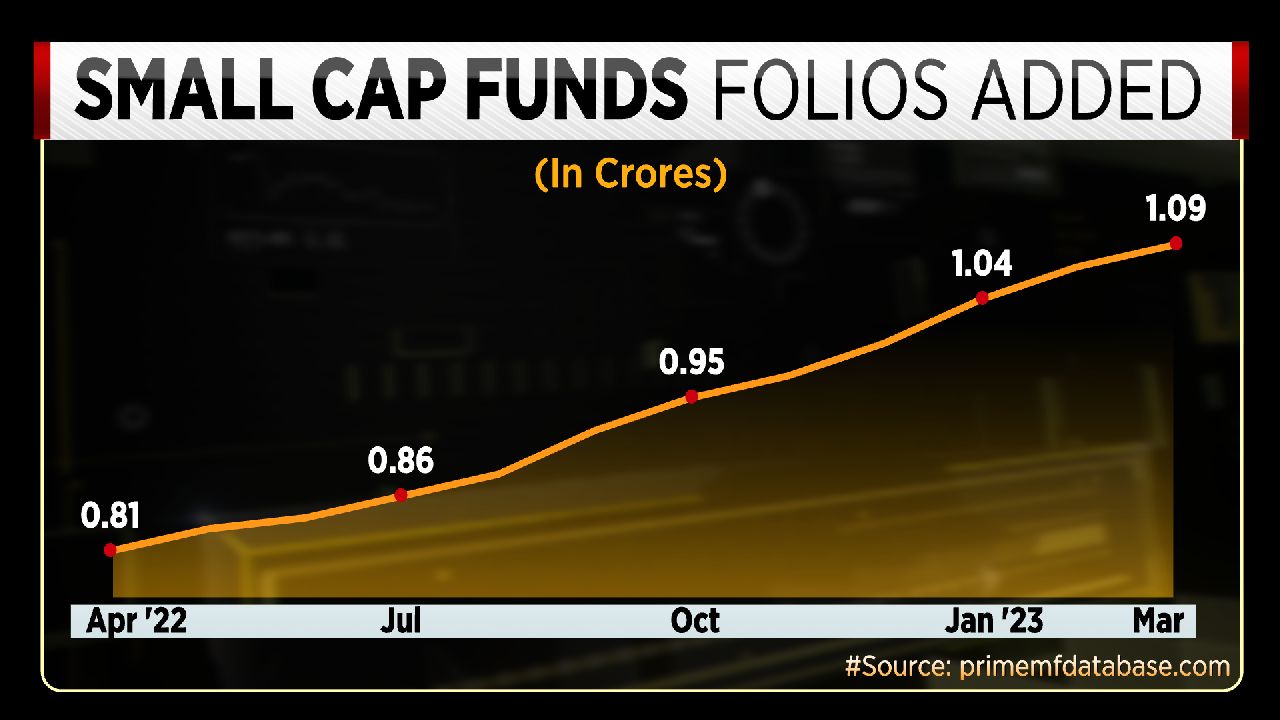

Let's delve into the number of unique folios added to this fund, which serves as a means of tracking one's holdings. In FY23, the fund experienced an addition of 11.3 crore folios.

The number of folios steadily increased from 81 lahks in April 2022 and concluded the year with a gain of more than 1 crore folios in March.

Notably, from December 2022 to April 2023, the number of folio additions remained consistently at or above 1 crore.

Speaking to CNBC-TV18, Trideep Bhattacharya, CIO-Equities at Edelweiss AMC, stated that small-cap valuations are reasonable versus mid and large-caps. He said that smallcap is the category to be in from a medium-term standpoint.

“On a daily basis, whether you look at large-, mid-, and small-cap, small-caps are looking at little attractive versus the growth expectations versus the mid and the large-cap. Secondly in a sideways market, people look to areas where the growth potential could be strong going forward,” he said.

Bhattacharya added, “I think I would not probably see the entire small-cap basket but the small-cap basket throw some very interesting opportunities, which are forward-looking and return strong growth prospects makes me believe that if somebody is looking to create stocks specific alpha, it is a good category to be in from a medium-term standpoint.”

Watch accompanying video for more