Interest rates may not head much higher from here, and that’s reason enough to lock-in the yield

Indications from the US markets and the Reserve Bank of India (RBI) suggest that interest rates may not have too much room more to run higher. This is good reason for investors to take a serious look at debt as an investment option.

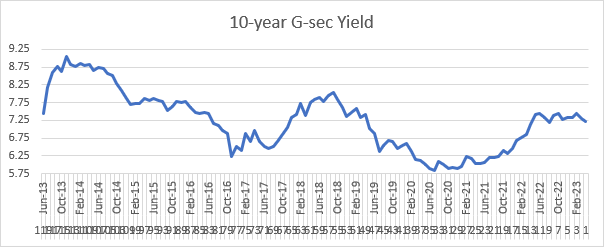

The recently released minutes of RBI’s Monetary Policy Committee (MPC) meeting suggest that there are concerns about the rise in interest rates hurting growth, and while there does seem to be also a sense to ensure that the inflationary demon is stamped out in one go, the pause in rate action at the last meeting suggests a tempered approach. What this suggests is that either rates will not be raised any more, or even if they are, the hikes could be small and limited from here. If that’s the case, and with most experts in the US expecting interest rates to start softening or plateauing in the latter part of the year, there seems limited risk of upside.

THE PEAK YIELD OPPORTUNITY

Debt investors don’t get such opportunities often, when rates are nearing their peak, to invest. And investments around these times tends to deliver handsome returns. To understand the implications of this, you need to have a sense of how bond prices are derived. While the formula is a little complicated, requiring a discounting of coupons and maturity value by the yield, what’s enough for a saver to appreciate is that when yields are at their highest, bond prices are at their lowest. It is quite like buying a stock at its lowest P/E value (or near a bottom). And conversely, when bond yields are at their lowest, bond prices are at their highest.

This presents an opportunity not just for earning a high yield on the debt instrument you buy into, till you hold it, but also a likelihood of gains from an upward movement in bond prices, if you decide to sell ahead of maturity—in a falling interest rate environment. While the Macaulay Duration formula is used to measure the extent of change in bond prices to yields, it is enough for savers to understand that there will be not just yield but gains too to be had when interest rates fall, and the extent of gains will often be determined by the residual maturity period of the debt instrument or bond. So, if you buy a bond with 10 years to maturity, your likely gains will be higher than on a bond with three years' maturity. So, go long if you have the appetite to allocate funds for the long-term, it is good to invest in debt today with a distant maturity period.

TIME TO START SIPPING

It never is easy to catch market tops and bottoms, and as a disciplined investor, you should not even try. It is to use a drip investing strategy or a Systematic Investment Plan (SIP) approach. If yields are near the top, you should just space your allocation in equal instalments over the next 6 months. So, for instance, if you wish to invest Rs 12,00,000 in bonds, you could invest Rs 1,00,000 every fifteen days over the next 6 months, or in 12 equal instalments. This will help you iron out any swings in yields and protect you against any adverse swings in bond prices.

NOT TOO LATE TO INVEST

Several investors rushed in before the year end to take advantage of the tax arbitrage on debt mutual funds, as the tax regime changes from April 1. But it isn’t too late, even if you didn’t. True, the tax edge debt mutual funds had is gone, but whether it be mutual funds or fixed deposits or direct investment in bonds, the next few months should be a good time to lock-in yields.

Interest rates too move in cycles and the present yields look like the best they’ve been since 2019. Even fixed deposit rates have perked up.

ATTRACTIVE YIELDS | |

| Product | Interest Rate |

| Post Office 5-Year FD | 7.50% |

| Post Office 1-Year FD | 6.80% |

| SBI 1 -Year to <2 Years | 6.80% |

| Kotak 365-389 Days | 7.00% |

| HDFC Bank 1-Year to 15 months | 6.80% |

| Axis Bank 1-Year 4 Days | 6.75% |

| Shriram Finance 1-Year | 7.60% |

| Mahindra Finance 1-Year | 7.40% |

| 10-Year G-Sec Yield | 7.20% |

Source: Bankbazaar.com for deposit rates

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!