What to expect on Dalal Street

Shetti of HDFC Securities says that the positive chart pattern of higher tops and higher bottoms is intact on Nifty's daily chart and there is no indication of any higher top reversal forming at the highs.

He expects the next upside level to be watched around the 19,000 mark in the short term with immediate support at levels of 18,720.

Key levels to watch out for

The 19,000 strike call for the December 8 weekly expiry added 41.4 lakh shares in Open Interest on Thursday while the 18,800 call added 29.4 lakh shares.

On the Put side, the 18,800 strike added another 32 lakh shares in Open Interest while the 18,700 and 18,900 strike puts added 12.5 lakh and 11.1 lakh shares respectively.

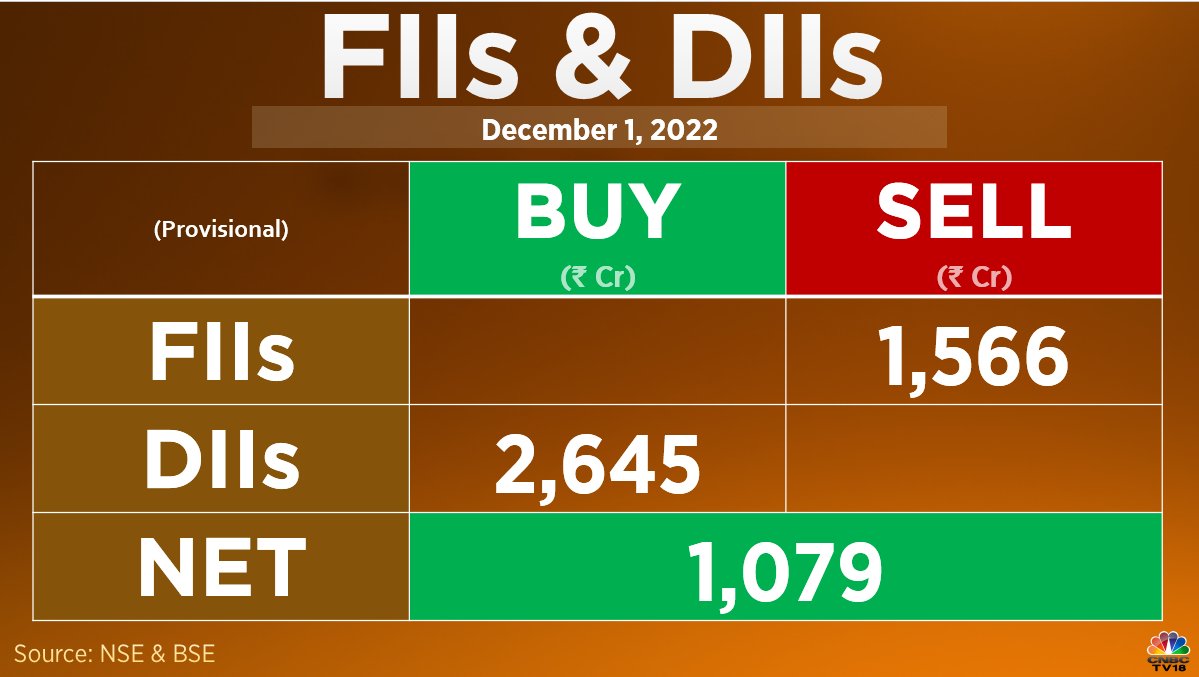

FII/DII activity

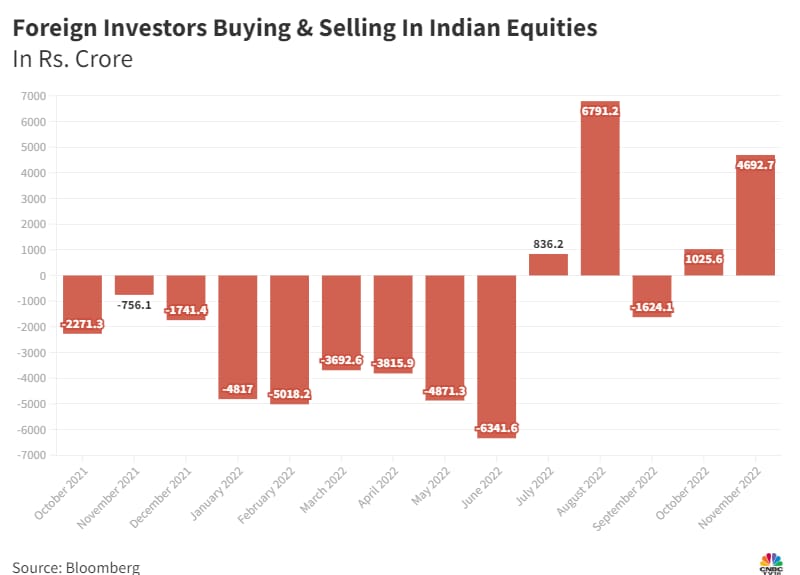

After offloading shares worth $33.3 billion between October 2021 and June 2022, Foreign Portfolio Investors turned net buyers of Indian equities, having cumulatively bought shares worth $11.7 billion since then.

While the Nifty 50 index fell 10.4 percent during that nine-month period between October and June, the index has gained nearly 20 percent since July.

Here are five stocks that saw an increase in open interest as well as price:

| Stocks | Current OI | CMP | Price Change | OI Change |

| Oracle Financial (OFSS) | 5,56,000 | 3,145.50 | 0.68% | 17.65% |

| Astral | 14,30,825 | 1,942.55 | 2.38% | 16.24% |

| Gujarat Gas | 50,05,000 | 509.8 | 1.47% | 13.11% |

| Rain Industries | 99,05,000 | 187.65 | 2.88% | 11.55% |

| City Union Bank | 73,20,000 | 191.3 | 0.74% | 6.86% |

Short build-up (Decrease in price and increase in open interest)

| Stocks | Current OI | CMP | Price Change | OI Change |

| Indraprastha Gas | 92,00,125 | 437.30 | -1.62% | 5.50% |

| Coal India | 3,15,88,200 | 227.70 | -0.65% | 5.25% |

| Granules India | 71,72,000 | 343.75 | -1.60% | 5.22% |

| Torrent Pharma | 15,36,500 | 1,652.45 | -0.88% | 5.13% |

| Mahanagar Gas | 28,34,400 | 907.85 | -0.20% | 4.85% |

Short Covering (Increase in price and decrease in open interest)

| Stocks | Current OI | CMP | Price Change | OI Change |

| Cummins India | 15,15,000 | 1,435.55 | 1.34% | -14.98% |

| LIC Housing Finance | 90,88,000 | 394.55 | 1.81% | -7.72% |

| UltraTech Cement | 18,31,500 | 7,330.50 | 2.73% | -7.07% |

| ICICI Lombard | 39,71,200 | 1,232.00 | 1.15% | -6.00% |

| TVS Motor | 74,68,300 | 1,053 | 0.43% | -5.29% |

Long Unwinding (Decrease In Price & Open Interest)

| Stocks | Current OI | CMP | Price Change | OI Change |

| Bandhan Bank | 5,19,93,000 | 236.60 | -1.27% | -13.10% |

| Apollo Tyre | 1,63,69,500 | 318.00 | -0.09% | -5.99% |

| RBL Bank | 4,39,60,000 | 154.10 | -0.10% | -5.59% |

| PI Industries | 17,44,250 | 3,496.10 | -0.30% | -3.86% |

| Indian Oil | 7,56,69,750 | 76 | -0.90% | -3.04% |

First Published: Dec 2, 2022 5:47 AM IST

auto stocks underperformed post monthly sales numbers.

auto stocks underperformed post monthly sales numbers.