This will also mark the first positive expiry for the Nifty 50 index after four consecutive negative ones.

The Nifty 50 is within touching distance of its April 13 high of 17,828, post which it went into a period of consolidation.

This will also mark the first positive expiry for the Nifty 50 index after four consecutive negative ones. Wednesday also marked the third straight day of gains for the index.

The Nifty 50 has gained 733 points so far in the April F&O series, which is the best since November last year. 15 more points in today's expiry session and the Nifty 50 will be set for its best F&O expiry in six months. The index had gained 919 points in October last year.

For today's session, aside of expiry, the index will react to earnings from the insurance twins - HDFC Life and SBI Life, along with Bajaj Finance.

Today will also be an earnings-heavy session as Hindustan Unilever, Tech Mahindra, Wipro, Axis Bank, and Bajaj Finserv will be among the Nifty 50 companies reporting results.

Rupen Rajguru of Julius Baer said that the market currently being too greedy for an interest rate cut and not being fearful enough about a recession and that the US Fed policy on May 3 will be crucial to get a sense of the Fed stance.

He finds relative value in sectors like healthcare, QSR and Insurance. He will prefer Auto Ancillaries over OEMs, and that financials will remain market performer.

What do the charts suggest for Dalal Street?

The Nifty 50 is set to break above the 17,900 mark and challenge the next resistance band of 18,000 - 18,200, according to Sameet Chavan of Angel One. Downside support zones are seen between 17,750 - 17,700. However, he does not rule out bouts of volatility since it is the options expiry session.

Rohan Patil of SAMCO Securities observed a bullish flag pattern breakout on the lower timeframe charts of the Nifty 50 index. He said that the index needs to cross 17,900 for further acceleration in momentum. "On the lower side, 17,650 and 17,600 will act as support zone for the index," he said.

For the Nifty Bank index, the trend remains bullish in the short term, with the new range being 42,500 - 43,000, said Rupak De of LKP Securities. "On the lower end, a fall below 42500 may trigger panic in the banking space; whereas on the higher end, a decisive rise above 43000 may induce further rally," he said.

Here are key things to know about the market ahead of the trading session on April 27:

SGX Nifty

On Thursday, Singapore Exchange (SGX) Nifty futures — an early indicator of the Nifty 50 index — fell 34.5 points or 0.2 percent to 17,795, thereby pointing to a subdued opening for the market.

Global Markets

Benchmark indices had another choppy day in the US as worries over First Republic overshadowed excitement around big tech earnings.

The Dow Jones fell over 200 points on Wednesday, while the S&P 500 fell 0.4 percent. The Dow was trading 100 points in the positive at one point during the session.

The Nasdaq ended 0.5 percent higher after trimming most of its intraday gains.

What to expect on Dalal Street

Ruchit Jain of 5paisa.com said that the Nifty 50 support has now shifted to 17,600 on the higher side. on the higher side, 50 percent retracement of the previous correction from its all-time high to 16,828 comes up to around 17,860. "A move above this will be seen as a continuation of the trend which could then extend towards 17,925-17,950 first, and then upto 18,060-18,100," he said.

The short-term trend of the Nifty 50 remains positive, said Nagaraj Shetti of HDFC Securities. "There is a possibility of minor consolidation movement at the highs before showing a decisive upside breakout for the near term," he said. Immediate support on the downside is seen at 17,700.

Kunal Shah of LKP Securities expects upside target of 18,000 - 18,200 in the near-term. "The monthly expiry indicates resistance at 18,000 where the highest open interest is built up on the call side," he said.

Key Levels To Track

For today's weekly and monthly options expiry, the 17,900 strike call on the Nifty 50 index added 32.1 lakh shares in Open Interest, followed by the 17,950 call, which added 27.3 lakh shares.

Open Interest addition was also seen in the 17,850 call (25.84 lakh shares) and the 18,000 call (11.66 lakh shares).

On the downside, the 17,800 put added 44 lakh shares in Open Interest, while the 17,700 and 17,750 put added 38 lakh and 35.5 lakh shares respectively.

Nifty 50's put-call ratio is now at 1.21 from 1.16 on Tuesday. GNFC has entered the F&O ban on expiry day, while Zee Entertainment continues to remain in the band.

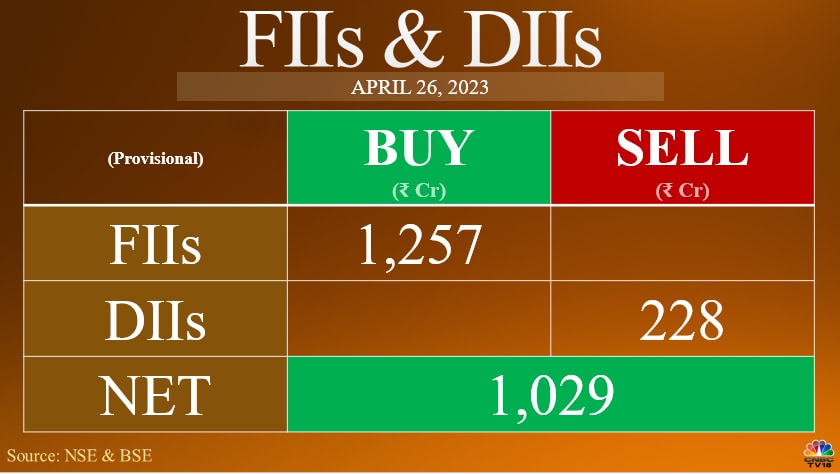

FII/DII activity

Short Covering (Increase In Price and Decrease In Open Interest)

| Stock | Current OI | CMP | Price Change | OI Change |

| InterGlobe Aviation | 5,33,700 | 2,015.05 | 1.05% | -65.36% |

| Dabur | 19,83,750 | 533.05 | 1.06% | -64.81% |

| Muthoot Finance | 9,00,350 | 1,020.70 | 0.15% | -63.93% |

| Bandhan Bank | 79,47,000 | 223.95 | 0.13% | -63.65% |

| BPCL | 27,28,800 | 348.15 | 0.22% | -63.60% |

Long Unwinding (Decrease In Price and Open Interest)

| Stock | Current OI | CMP | Price Change | OI Change |

| Sun Pharma | 20,09,700 | 970.65 | -0.26% | -79.90% |

| Chola Fin | 7,91,250 | 838.00 | -0.26% | -78.85% |

| Abbott India | 6,640 | 22,278.90 | -0.22% | -70.77% |

| IEX | 69,33,750 | 152.30 | -0.13% | -67.78% |

| MCX | 1,94,800 | 1,389.00 | -6.84% | -65.34% |

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!