Home

Terms and Conditions

Technical stock picks | Britannia, Havells, RIL, Gujarat Gas on the radar

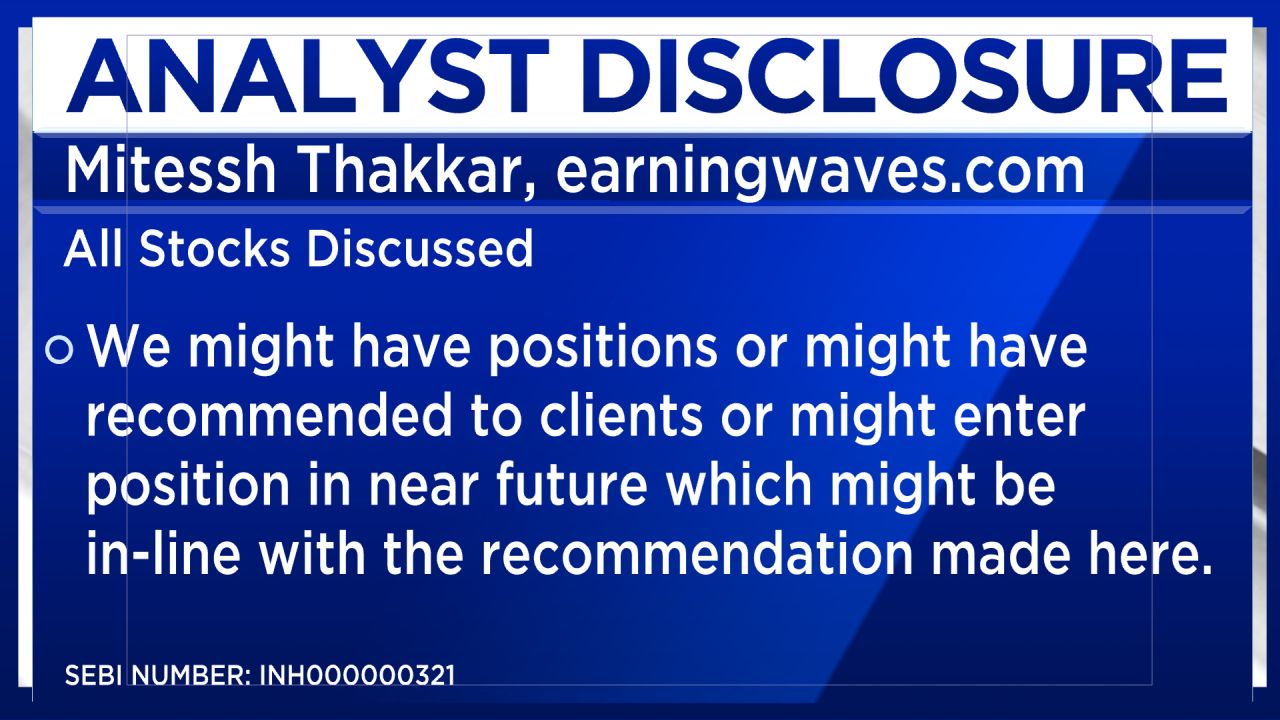

buy call of the day is on Britannia Industries. It showed good price and volume breakout yesterday, so on a mild dip around 15-20 points at Rs 4,380-4,385 could be good entry point for the stock. One can buy with a stop loss of Rs 4,340 and target of Rs 4,500 or thereabouts. The stock was up 4.63 percent in the past month.

buy call of the day is on Britannia Industries. It showed good price and volume breakout yesterday, so on a mild dip around 15-20 points at Rs 4,380-4,385 could be good entry point for the stock. One can buy with a stop loss of Rs 4,340 and target of Rs 4,500 or thereabouts. The stock was up 4.63 percent in the past month.Havells India is a second buy call for Thakkar. He recommends a buy with a stop loss of Rs 1,199 and targets of Rs 1,250. Shares have gained 4.29 percent over the last month.

Thakkar's third buy call is on Reliance Industries. The stock has been making that high of Rs 2,381 for the last two days. He recommends a buy at 2,385 with a stop loss at Rs 2,370 and Rs 2,420 is the first target area. The stock was up 6.32 percent in the past month.

Thakkar has a sell recommendations Gujarat Gas. His recommendation comes with a target of Rs 444 and a stop loss of Rs 465. The stock was down 3.46 percent over the last one month.

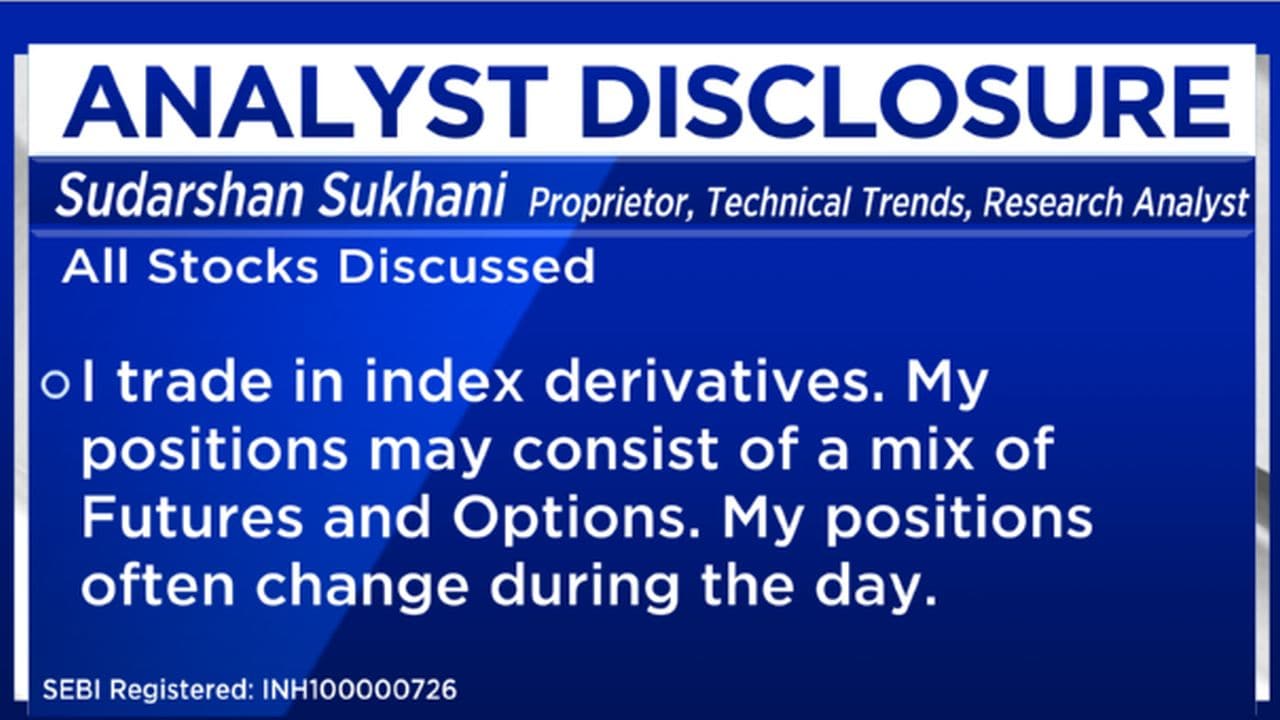

From Sudarshan Sukhani

Sukhani finds a buying opportunity in Bajaj Finserv. The stock had rallied, and consolidated and now a breakout is imminent and use dips like today to go long in good quality stocks. The stock was up 8.66 percent in the past month.

Sukhani recommends intraday short is on Granules India. This stock has been weakening, it is distributing apparently, and some lower levels are likely to come in. Shares have gained 4.69 percent over the last month.

Same is the case with ICICI Prudential, there was that big disappointment, the stock is probably going into a correction and Sukhani recommends intraday short on it. The stock was up 3.0 percent in the past month.

Lastly, he recommends buying Tata Power, the stock had consolidated for a long period of time. He reiterated that quality stocks need to be bought when they are consolidating or when they are going through minor dips. Shares have gained 5.30 percent over the last month.

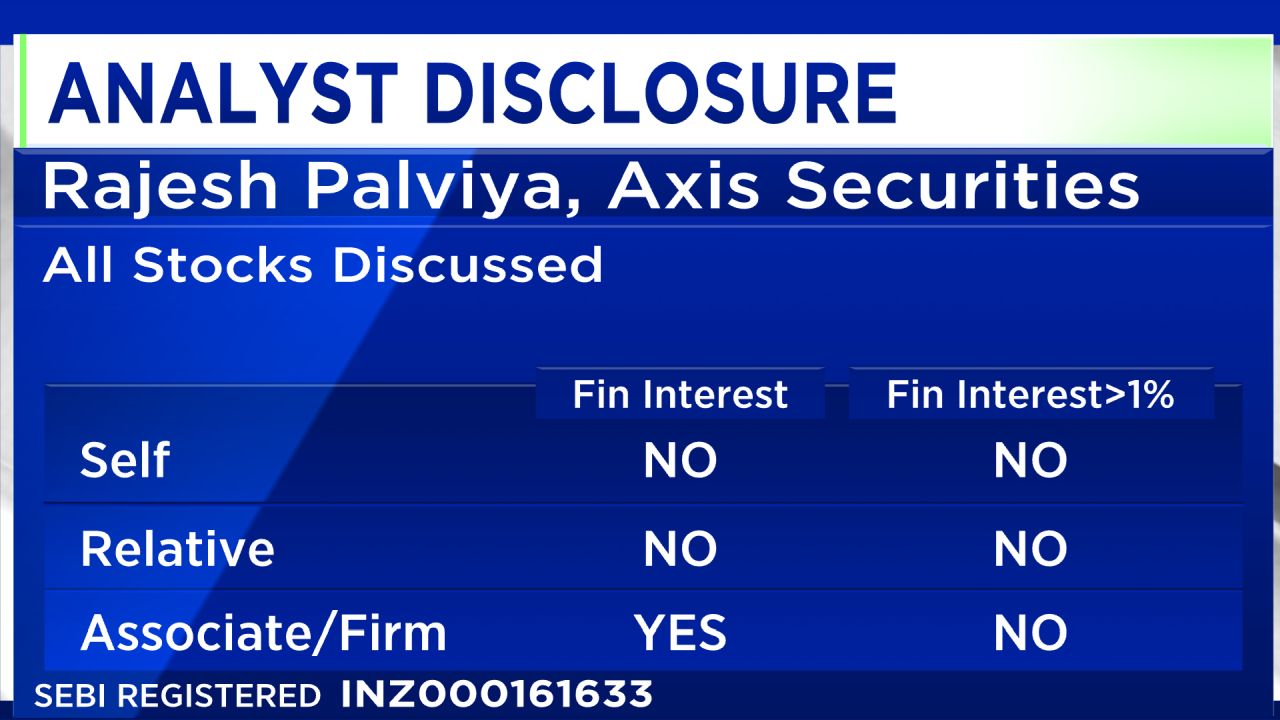

From Rajesh Palviya

Rajesh Palviya first buying recommendation is on Aurobindo Pharma. The stock is witnessing breakout on its weekly and monthly chart and it is a third consecutive month where it is exhibiting its bullishness. Palviya is projecting target of Rs 630-640, and recommending to buy with a stop loss of Rs 590. The stock was up 18.99 percent in the past month.

Palviya’s second buy recommendation is ABB India. The stock has shown short covering action in the previous trading session. Looking at the overall setup the stock is in bullish territory for long term setup. Palviya believe that ABB can further scale up higher from the current level and possible target in the short-term can be towards Rs 3,430-3,450. One can buy this stock with stop loss of Rs 3,290. The stock was up 0.61 percent in the past month.

Palviya has buy recommendation on Canara Bank, the stock is looking very attractive. According to Palviya the stock can move further higher from the current levels, Rs 325 to 330 could be the possible target and one can buy this stock with stop loss of Rs 300. Shares have gained 10.53 percent over the last month.

Disclaimer: The views and investment tips expressed by investment experts on CNBCTV18.com are their own and not that of the website or its management. CNBCTV18.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: Network18, the parent company of CNBCTV18.com, is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

First Published: Apr 26, 2023 9:28 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!