Two events last week have given the global markets a new direction and its not a pleasant one. One of them has been a surprisingly hawkish testimony from Fed Chair Jerome Powell and the other being the sudden collapse of two financial institutions in the US - crypto-focused bank Silvergate and regulators taking over the operations of Silicon Valley Bank.

Home

Terms and Conditions

homemarket NewsInflation, Bank Collapses, Jobs Data: Global markets jittery ahead of March 21 FOMC meet

Inflation, Bank Collapses, Jobs Data: Global markets jittery ahead of March 21 FOMC meet

By Reema Tendulkar | Mar 13, 2023 6:49 AM IST (Published)

Mini

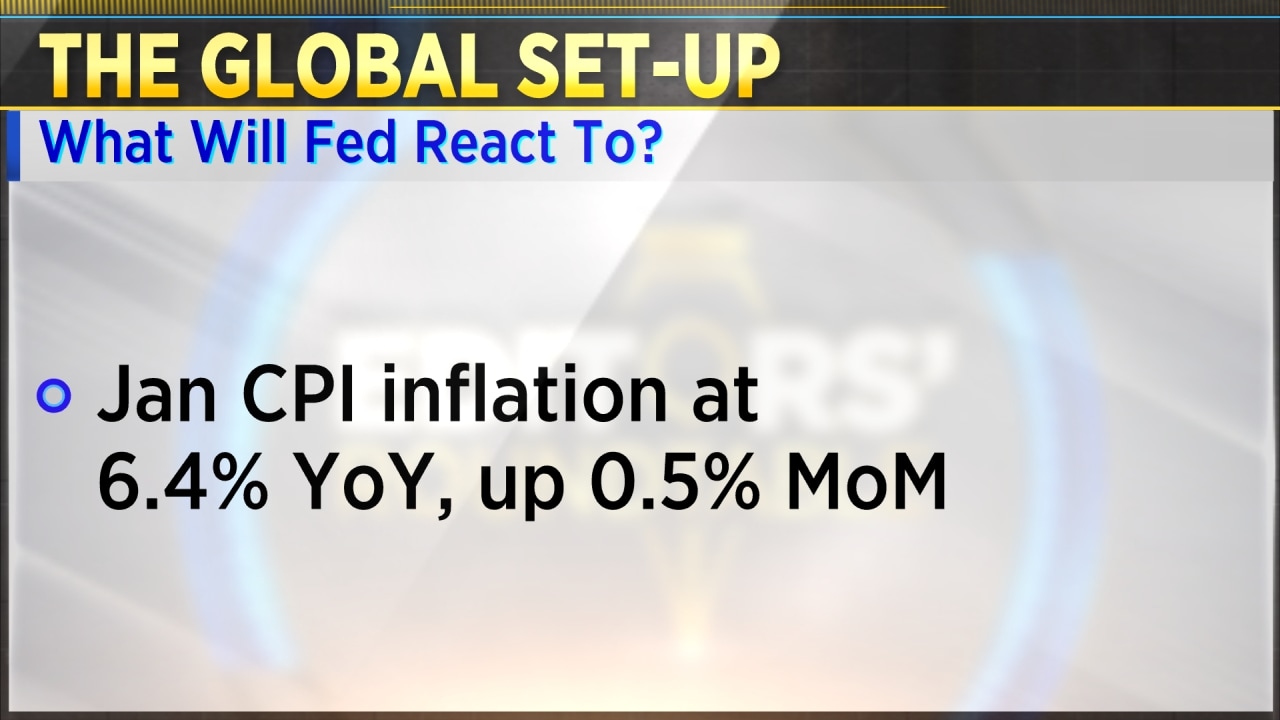

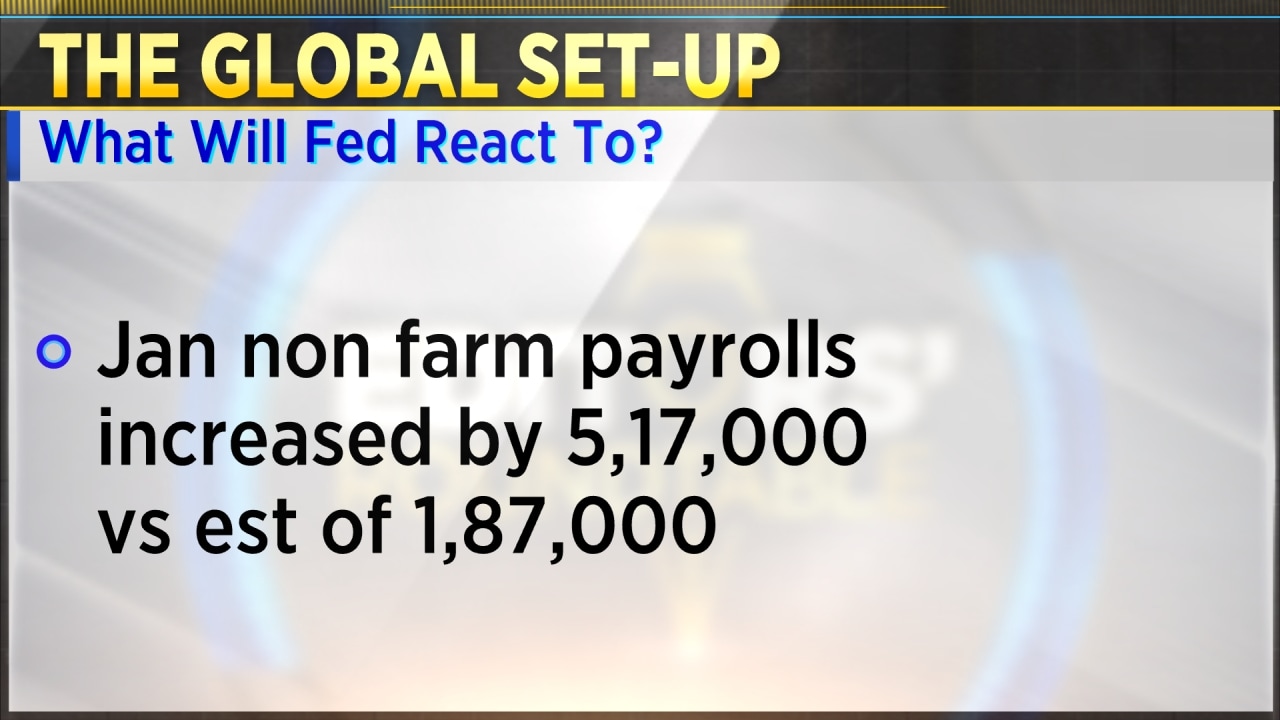

The next FOMC meeting is on March 21 and 22 and it will be reacting to January and February jobs and inflation data.

market | Mar 13, 2023 6:49 AM IST

X