Global markets have also become a little better this week, especially compared to the last two weeks. The last two weeks were completely manic. And this week, things seem to be settling down.

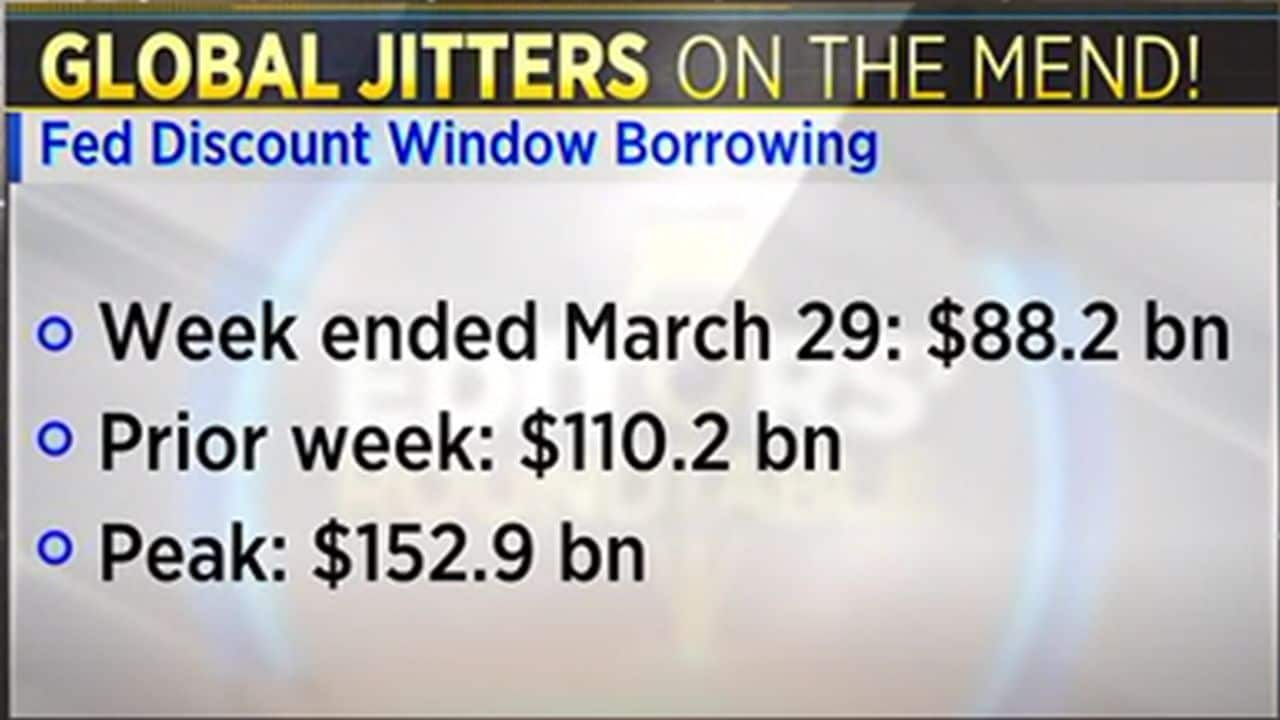

However, one data point which shows more than anything, whether things are settling down, is how much are banks borrowing from the Fed’s discount window. That's the big backstop and when banks are in trouble in the US, they go to the Fed and borrow largely from the discount window. That number of week-on-week has been coming down.

The latest data for the week-ended March 29 shows that from the peak of $152 billion to $153 billion two weeks ago, it now stands at $88 billion or so.

The big unknown

If the US markets, as many believe, will face trouble at some point in time, that is a big unknown and one can't do away with the fact that the correlation is pretty high.

The data since 2001 shows that monthly returns for emerging markets, the EM index and the US are correlated in the same direction 84 percent of the time. That is a pretty steep significant correlation. So, one will want the global markets also to do well.

It is no longer the 2021 market, where whichever way the world went, the market here will continue to do well, earnings of course start next week and the market will take note of that.

After the third quarter, there were steep earnings downgrades for FY24. That is something that one would want to see running in the opposite direction, at least some stability in earnings, commentary, etc. will go a long way in helping the market find a little bit of floor.

For more details, watch the accompanying video