SUMMARY

Morgan Stanley has maintained an 'overweight' rating on Bajaj Auto with a target of Rs 5,063 per share, while Nomura has maintained a 'buy' rating on Tata Consumer Products with a target of Rs 880 per share.

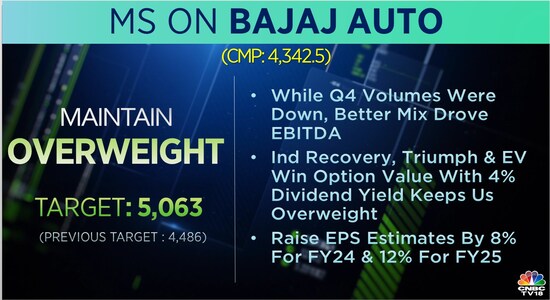

Bajaj Auto | Morgan Stanley has maintained an 'overweight' rating on Bajaj Auto with a target of Rs 5,063 per share, from its previous target of Rs 4,486 per share. It says that while the company's fourth quarter volumes were down, better mix drove EBITDA.

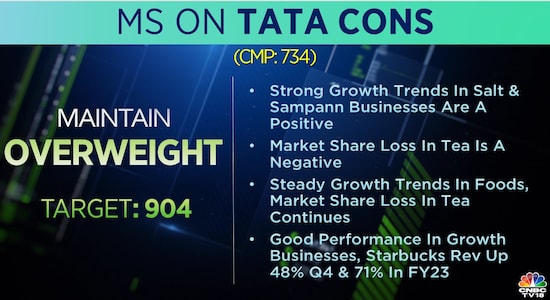

Tata Consumer Products | Morgan Stanley has maintained an 'overweight' rating on Tata Consumer Products with a target of Rs 904 per share. It says the market share loss in tea is a negative.

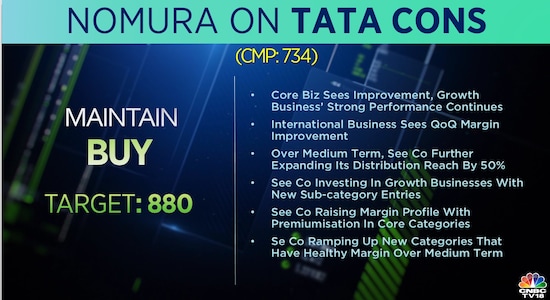

Tata Consumer Products | Nomura has maintained a 'buy' rating on Tata Consumer Products with a target of Rs 880 per share. It says the company's core business sees improvement, while its growth business' strong performance continues.

Nestle | Morgan Stanley has maintained an 'underweight' rating on Nestle, with a target of Rs 15,315 per share. It says it remains underweight given weaker growth in the largest category.

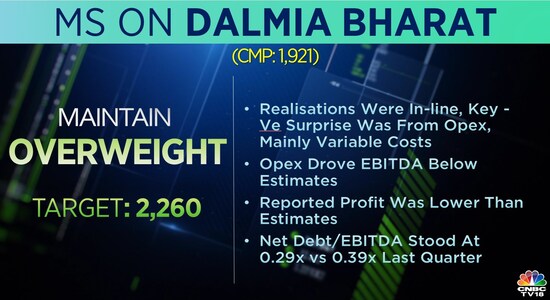

Dalmia Bharat | Morgan Stanley has maintained an 'overweight' rating on Dalmia Bharat with a target of Rs 2,260 per share. it says that the profit reported by the company was lower than estimates.