Home

Terms and Conditions

2021: The year B2B e-commerce startups cleared the pandemic stress test

Here is what’s noteworthy.

Before 2019, all four startups struggled to raise big money as investors offered a range of reactions from confusion to cynicism. The conviction came later!

Together, the four startups were intent on digitally orchestrating India's disjointed supply chains. They wanted to help MSMEs end-to-end: from procuring raw materials and managing workflows to fulfilling export orders while offering an e-commerce platform, much like Amazon or Flipkart, but for industrial goods. Add to it financing. Eyebrows touched the roof.

Prayank Swaroop of Accel — the common backer of Infra.Market, Moglix, and Zetwerk — sums it up. That’s “trying to upend the supply chain in a centuries-old manufacturing industry.”

Many industry insiders said, “It won’t work!”

Lightspeed’s Vaibhav Agrawal recalls. Before investing in Zetwerk, when the venture capital firm first met the startup’s founders, who at the time were building an ‘OS for Manufacturing’, the response within was, ‘What in the world is that?’

Despite having worked as a VC, following a stint as a Mckinsey consultant, OfBusiness’ co-founder Ashish Mohapatra faced at least 70 rejections before Matrix Partners India, his former employer, opened the purse strings.

The two co-founders of Infra.Market was bootstrapped for three years before Accel offered seed funding in mid-2019.

Then, there was resistance from MSMEs too. "We would walk into a manufacturing customer, who would say I use Flipkart… But, in my professional life, this is how I have done it in a certain concept for 20-30 years," explained Moglix’s Rahul Garg.

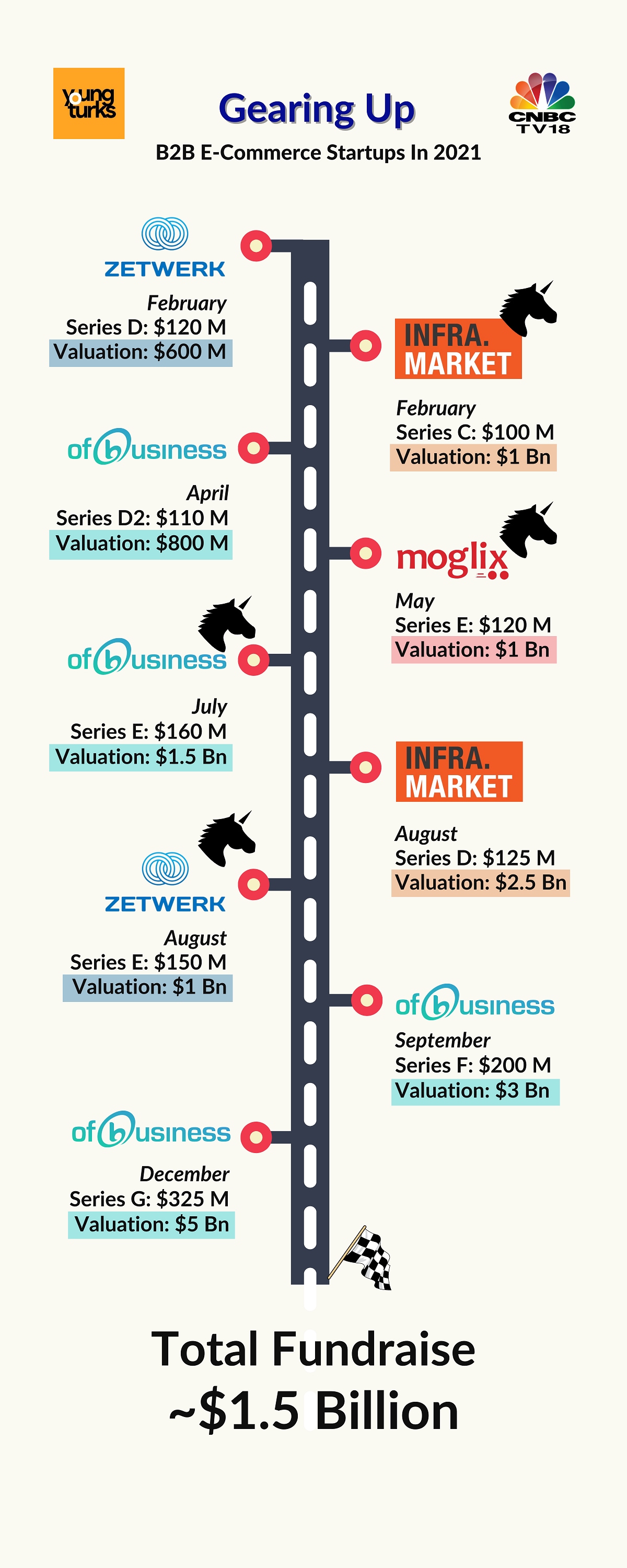

Cut to this year, which has been the best ever, the four startups have raised massive funds in multiple rounds. Each time, pocketing a cheque for $100 million or more.

What changed? Why did the world’s top investors — Tiger Global, Sequoia, SoftBank, Accel, Falcon Edge (now Alpha Wave Global), Lightspeed, Matrix and others — show up to occupy the captable, often sharing seats with each other, at one or more of these four startups?

2019 is a good marker for what came — before and after — which led to the rapid rise of these ‘steel to spanner’ B2B e-commerce startups.

In the preceding years, Indian manufacturers had faced multiple disruptions. Firstly, demonetization, which puts MSMEs on the path to cashless trade. In other words, digital payments. Secondly, GST. The government’s insistence on electronic visibility for filing taxes has brought transparency.

It eased trade too. “Only post-GST have we expanded rapidly. We have been able to scale without having to work with each of the state or central jurisdictions, which were separate,” said Rahul Garg, Founder, Moglix.

The startup works with over 16,000 suppliers and runs hubs in 35 Indian cities to procure and distribute industrial goods ranging from pump sets and toolboxes to welding machines.

In 2018, the first signs of the trade war between the US and China began to surface. Global companies, particularly the American ones, were looking to ease their supply chains out of China.

“Globally, what's happening is most companies are following a China+1 strategy. They no longer want to rely on a single country for all of their sourcing needs,” said Amrit Acharya, Co-founder, and CEO, Zetwerk.

The manufacturing platform connects more than 10,000 suppliers with over 600 companies to transform custom designs into finished products from nail clippers to aircraft engine components.

Come 2019, the trade war hit a crescendo as the U.S. and China ring-fenced each other with tariffs. The red flag went up. Both companies and startup investors pulled out the global map to pin down alternative manufacturing destinations.

Alongside South-East Asian countries, “India became a very important destination,” Acharya told CNBC-TV18, highlighting the fact that most of Zetwerk's 100-odd international clients were buying from India for the first time. The startup currently gets over 25 percent of its revenues from over 15 international markets, primarily led by the US.

(Image: Reuters)

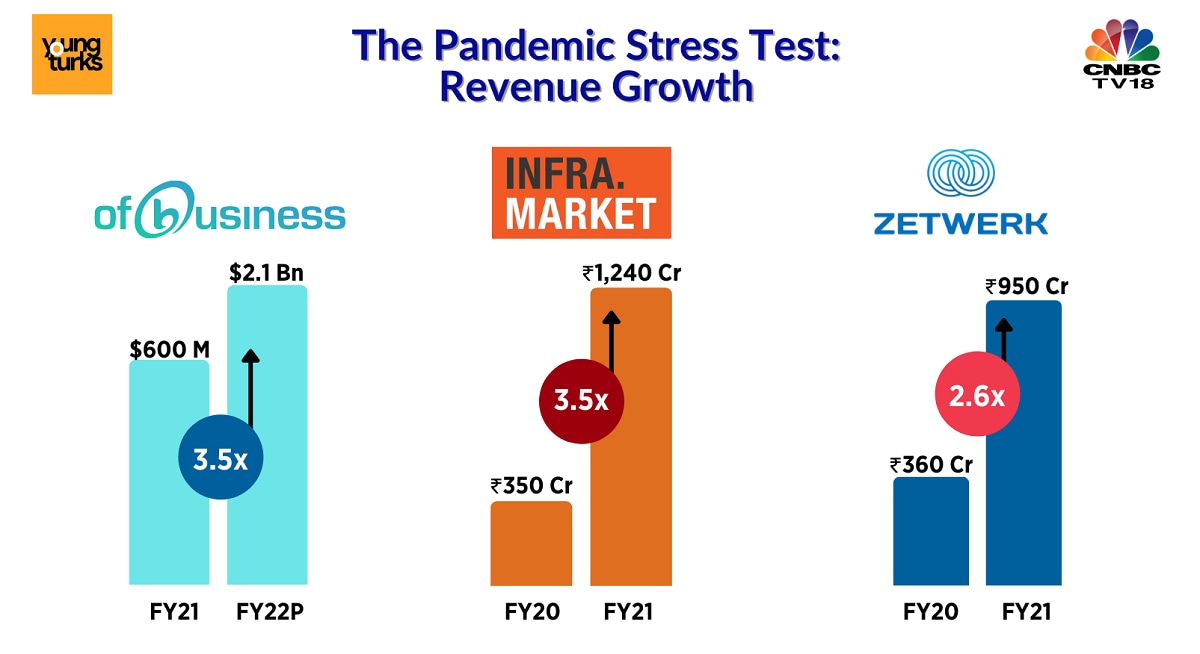

(Image: Reuters)In 2020, the pandemic turned the world upside down and snapped the conveyor belt of the global supply chain. A terrible time, but it provided the booster shot, with supply-chain managers compelled to take B2B online routes for procurement of industrial and construction products.

"Lots of brands, who wanted to deliver their construction material to retailers or B2B companies, started depending more and more on us, as their traditional distributors had to back out during the pandemic," said Souvik Sengupta, Founder, Infra.Market. The startup allows customers to place orders for sand, cement, and other construction material — online.

Tiger Global's Scott Shleifer — a surprisingly early investor in the startup — proudly reiterates the founder's view, "Infra.Market has become the go-to partner especially during the pandemic..."

"Today, 10 percent of our business is exporting. We export to countries like Singapore, Hong Kong, Dubai, Jordan, Italy, and the U.S.," said Sengupta, with plans of reaching global shores by setting up a subsidiary abroad.

(Image: Shutterstock)

(Image: Shutterstock)Following the global tailwinds, another of Tiger Global’s portfolio companies — Moglix — has gone truly global by setting up a base in UAE. Currently, it is linking up with suppliers and manufacturers in 120 countries. Going forward, it plans to use India and South-East Asia as a major sourcing hub.

Besides Moglix and Infra.Market, Tiger Global is also an investor in OfBusiness. The global VC firm recently co-led the $325 million Series G round with Alpha Wave Global and SoftBank, turning OfBusiness into the most-valued startup in the space at a valuation of approximately $5 billion.

OfBusiness, which helps over 700,000 SMEs across 24 states procure raw materials, has expanded to nine different supply chains, including industrial chemicals, food grains and polymer packaging.

That's in addition to its existing categories like industrial or construction steel. "Because of supply chain disruptions, it was actually easier to dis-intermediate some of the existing intermediaries. For us, the last 1.5 years has been the timing of the opportunity," said Ruchi Kalra, Co-founder, OfBusiness.

Investors too find this to be an opportune time. Sequoia India’s Shailesh Lakhani — the common investor in Moglix and Zetwerk — told CNBC-TV18, "An area where we are seeing a lot of interesting companies is in manufacturing, which is something we never would have predicted a few years ago. India is getting much better at making many different types of products and services. We are seeing fast growth."

Moglix’s Rahul Garg sees a 100x growth opportunity. “We cater to the manufacturing and infrastructure sector, which is going from more than $500 billion to be a $1 trillion sector. We are still getting started. After five years of launch, we are still catering to less than 1 percent of the market,” he told CNBC.

In FY21, manufacturing contributed slightly under 18 percent to India’s GDP. A marginal uptick from more than a decade ago in 2000.

To boost this figure and revive manufacturing after the disruption caused by the pandemic, the Indian Government, over the last two years, has announced a string of schemes, alongside the ‘Make In India’ initiative. Most notably, Production Linked Incentives (PLI), with a total outlay of about Rs 2 trillion for 14 priority sectors.

For MSMEs to be able contributors, the credit gap must narrow. A World Bank report says 4 out of 10 of Indian MSMEs, including the manufacturers, lack formal credit. Lack of proper paperwork is the key reason behind banks and other traditional lenders rejecting loan applications.

(Image: Reuters)

(Image: Reuters)To solve this, Moglix and OfBusiness are using technology to finance SMEs, who otherwise would find it tough to meet working capital needs.

"We started with a simple vision. We wanted to have frictionless B2B commerce. Now, whatever needs to be built for it, needs to be built for it," explains Rahul Garg, Founder, Moglix.

So far, Credlix — Moglix’s supply-chain financing arm — has disbursed loans worth $100 million to over 2,500 MSMEs. With an aim to finance exporters, it recently acquired NuPhi, a Singapore-based fintech startup. “We see that from $100 million, we should be $1 billion over the next 9-12 months,” said Garg.

"NPAs is zero right now because these are already built on high-quality commerce transactions," he explained. Both Moglix and ofBusiness are using their B2B e-commerce platform and Software As A Service (SaaS) solutions as data engines to assess credit risk before lending.

So far, Oxyzo — OfBusiness’ lending arm — has disbursed cash-flow-based financing worth $280 million to over 4,500 MSMEs. The MSMEs use the funds to buy raw materials on or off the OfBusiness platform. The company expects the assets under management (AUM) to grow 100 percent (YoY). It has been profitable since its inception.

"Why is that possible for such a large book and within a span of 3-4 years despite the fact that we already have a lot of leverage in terms of banks giving us lending so that we can lend ahead? That's primarily because of technology, which enables great monitoring through various triggers. That ensures that our credit risk, in terms of NPAs, is as low as 1.2 percent," said Ruchi Kalra, who heads the vertical for OfBusiness.

For Moglix and OfBusiness, financing is the third leg of the business. The other two being the e-commerce vertical and SaaS offerings. The three verticals feed off each other and enable the startups to provide a full-stack offering to SME users.

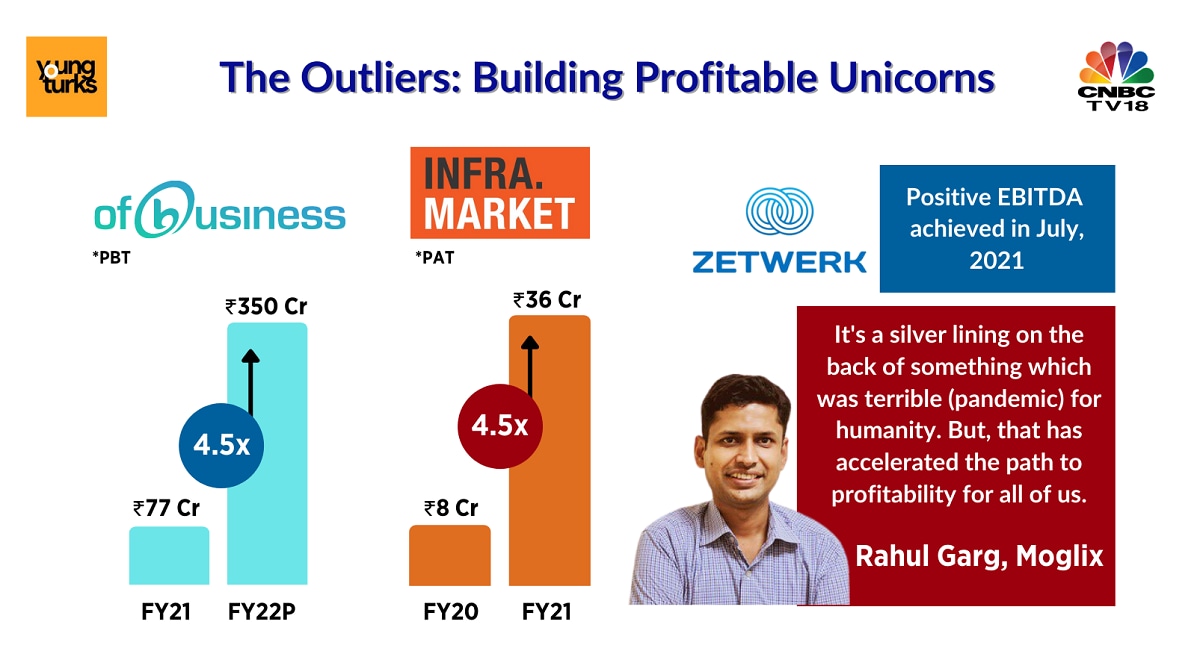

These startups built the entire stack because none of it — procurement and financing to distribution — was present in the country on a single platform for the B2B user base. To be noted, they are building and growing their startups with profitability. Not a thing most B2C unicorn peers can boast of.

Zetwerk, the youngest unicorn of the lot, turned profitable at an operational level just before achieving its billion-dollar valuation in August.

“From day one, we have been generating margins from every order,” said Amrit Acharya, Co-founder & CEO, Zetwerk. “So, definitely, the plan is to grow, but in a capital-efficient manner. Being profitable is a feature, not a bug of our business model,” he added.

“What's happening today is when we go to our customers and explain the business, most of them have heard about us. A few years back, hardly anyone knew us. Today, the incremental cost of acquiring a customer has been the lowest for us.”

Moglix’s Rahul Garg concurs, “The beauty of B2B is, we are a lot more sales driven, than marketing-driven. We don't lose the same amount of dollars for the revenue we generate."

Infra.Market’s co-founder Souvik Sengupta believes the lack of initial funding taught valuable lessons. “For the first 3 years of our business, we were bootstrapped. That sort of emphasized our focus on profitability. Once unit economics was in place, then using venture capital to grow or scale the business became much easier."

The unicorn status is new, but not profitability, he told CNBC-TV18.

OfBusiness, the most-valuable unicorn of the lot, has been profitable for the last four years. Co-Founder Ruchi Kalra points out, “Valuation is an outcome of the value driver. For us the value driver is growth and profitability. If you look at ofBusiness valuation, it's a straight multiple in terms of growth and the profitability that it has been delivering.”

With an IPO planned in the next 12 months, a profitable B2B startup with profits to show is a tempting prospect for stock market investors, who have been struggling to convince themselves to invest in loss-making internet startups heading to Dalal Street.

B2B e-commerce startups. Unsexy businesses? Maybe, as admitted by one of the founders. Unaspiring? Not at all.

Ruchi Kalra highlighted it with a chuckle. “We have some of these aspirations. Let's build commerce like Reliance. Let's build a credit culture and a fintech like Bajaj Finance. You put it all together and say, 'How do I do the Raj of the B2B marketplace? We often joke like that.”

First Published: Dec 30, 2021 4:49 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!